Call 800.416.WORK (9675) for a FREE CONSULTATION!

What is the Employee Rentention Tax Credit (ERC)?

Millions of business owners were negatively affected by COVID 19. Mandatory shutdowns, changes to your business operation, how you served customers, supply chain problems, employee retention problems …were just a few of the many problems business owners faced from 2019 to 2021. Many business owners are still feeling the effects.

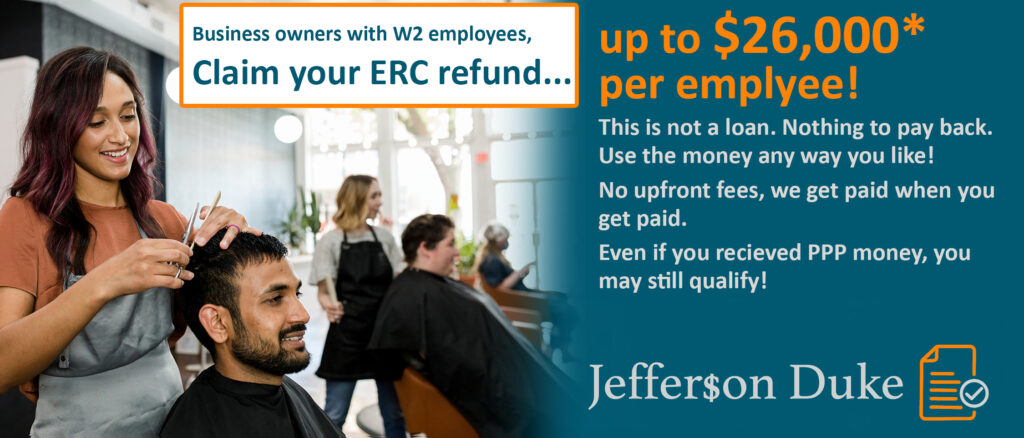

To provide relief to businesses Congress passed the CARES Act (Coronavirus Aid, Relief & Economic Security). They included the Employee Retention Credit as part of the CARES Act. Any eligible business can receive a refund up to $5,000 per employee for all of 2020 and up to $7,000 per employee kept on W2 payroll for each quarter 1, 2 & 3 of 2021 ($21,000). Meaning, generally, the total maximum refund is up to $26,000 per employee that was retained on your payroll during this time. Call Jefferson Duke at (800) 416.WORK (9675) for your free consultation to see if your company may qualify for the Employee Retention Credit.

So how does a business qualify?

Your small business is eligible to receive an ERC refund if it meets either of the following criteria:

OPTION A:

Your business saw a decline in gross sales/receipts in 2020 & 2021 compared to 2019.

OPTION B:

Your business operations were negatively impacted due to a government order for COVID 19 resulting in limitations of commerce, travel or group meetings for commercial, social, religious or other purposes…

Did your business have to shut down as required by the government? (ex: gyms, hair salons, etc.)

Did you have problems accessing your vendors/suppliers?

Were you forced to operate your business differently? (ex: indoor seating for restaurants)

…the list goes on.

Frequently Asked Questions for the Employee Retention Tax Credit (ERC)

How much does Jefferson Duke charge for the Employee Retention Tax Credit (ERC)?

We do not charge any upfront fees whatsoever. We will not ask you for a credit card or any forms of payment upfront. Once you retain our services, we will gather all the necessary payroll documents, analyze that information, calculate your expected refund and upon your signed approval, then file for your ERC refund. Our fee is a small percentage of your received refund. In other words, if you don’t get paid, we don’t get paid. For companies with 4 or more qualified W2 employees we charge 15%. For companies with 3 or less qualified W2 employees we charge 19.5%.

Does every business qualify for the ERC refund?

No. But a very large percentage of businesses do. Many businesses were affected by COVID. Some examples of reasons your business would qualify include:

- Reduction in gross sales.

- Reduction in sales due to COVID (lockdowns orders)

- Supply chain issues with vendors and manufacturers

- … and many other reasons.

What is the ERC (Employee Retention Credit)?

The ERC is part of the CARES ACT. It is a refundable payroll tax credit to companies that qualify. The goal of the ERC was to provide financial relief to those businesses that retained employees during COVID. Originally only eligible companies could take PPP or ERC, but in 2021 Congress amended the provision to all companies to apply for both.

So, if your company received PPP money your business may also now qualify for ERC.

.

Is the ERC a loan?

No. It is not a loan. There is no interest rate. You can use the money for your business any way you wish.

How long does the ERC process take?

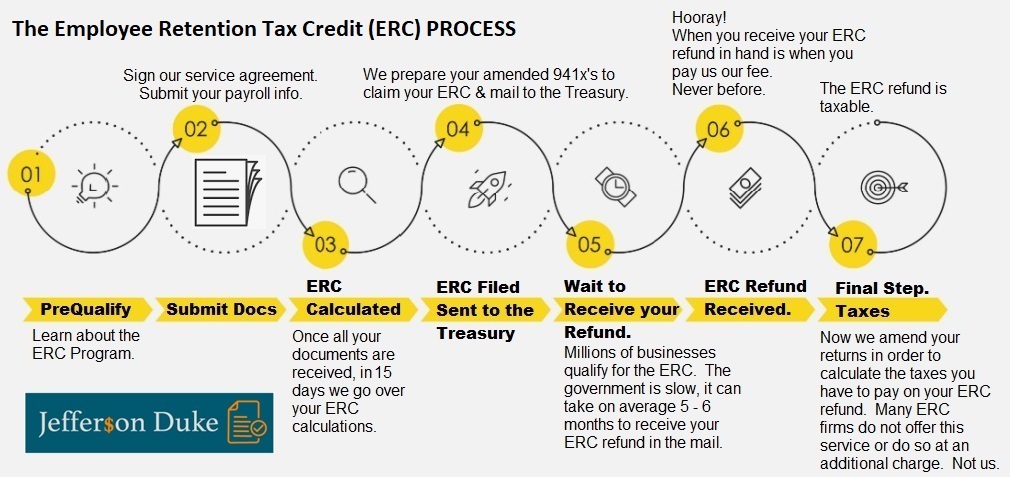

Step 1: Initial consultation over the phone. 15 minutes…or as long as you need.

Step 2. After the initial consultation we will send you an email outlining the payroll documents we need from you such as your IRS Form 941’s you already filed. All the documents we request you most likely already have on hand.

Step 3. We will prepare your amended 941 Forms. Then your amended 941x’s are mailed to the Treasury.

Step 4. Now we wait on the Treasury; which is currently backlogged. We have seen anywhere from 5 – 6 months on average for customers to receive their checks/refunds. But the wait can be much longer 10 – 14 months; we have no control over how fast the government processes your file or refund.

Step 5. You receive the ERC refund. Once you do, we will send you an invoice for our fee (% of the ERC) of the collected funds you received as we agreed upon.

Another company told me I didn’t qualify for ERC.

That may be true. But not all companies that provide ERC services are created equally.

It doesn’t hurt to call our specialist and submit your documents so we can review. Maybe the other company missed something Jefferson Duke wouldn’t.

Again, we only get paid if you get paid. We charge no upfront fees to review your file.

Is the ERC Employee Retention Tax Credit taxable?

Yes. And what makes Jefferson Duke different from many ERC providers out there is that our fee includes amending your taxes for 2020 & 2021. After you have received your ERC refund in order to pay the taxes you owe on the ERC funds we will amend your returns so you can pay the tax liability right away. Many ERC providers only get you the ERC refund, then send you to your own accountant or CPA to amend your taxes. Hopefully your accountant is fluid with ERC filings and usually their fees can range from $500 to $5,000. Not Jeffferson Duke, we handle it and it is all included in our fee.

Do I qualify for ERC if I took the PPP?

You can. On December 27, 2020, Congress modified the ERC credit rules to the CARES ACT. It allowed a company to have a PPP loan and still take the ERC Credit. However, the calculation of funds you would receive is then calculated differently. Our specialists will take this into account and get you every penny you are entitled to.

Why can’t I have my accountant/CPA file? Why use Jefferson Duke for the ERC?

Sure, you can but if your CPA/accountant was already proficient they should have called you and filed them for you already. There are tens of thousands of pages of tax code. We specialize in the ERC. Secondly, your CPA usually handles business income tax returns and not necessarily your payroll returns where the ERC credit is determined. Plus, your CPA or tax preparer typically charges you a fee upfront. At Jefferson Duke we don’t get paid until you get your ERC refund.